How to not run out of runway - the seed stage growth model

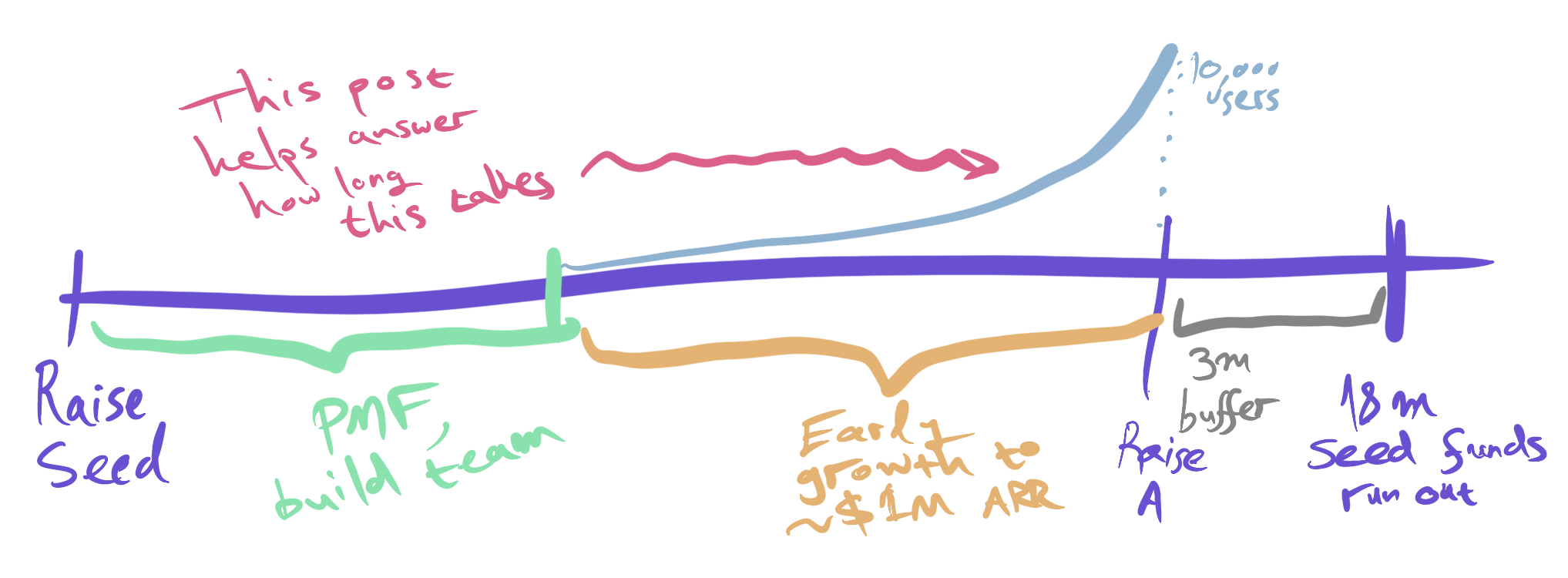

There’s lots of startup advice floating around. I’m going to give you a very practical one that’s often missed — how to plan your early growth. The seed round is usually devoted to finding your product-market fit, meaning you start with no or little product and should end with a demonstrably retentive and growing population of users. It’s this growth stretch that I’ll tell you how to plan — and once you do that, you’ll have a clear timeline for your seed:

The three steps of a classic seed round: Search for PMF, Early growth, and fundraising.

The three steps of a classic seed round: Search for PMF, Early growth, and fundraising.

While there are differences, Series A is broadly raised when you have early traction, evaluated through growth rates and ARR or potentially-monetizable userbase.

- What’s a good userbase? One that could or is generating about $1M ARR.

- Why $1M ARR? Because your series A will be in the vicinity of $10M valuation, and x10 is generally the multiple used at this stage. There are many variations, but rarely order-of-magnitude ones. (2024 note: This post was written pre-pandemic)

- What’s a good growth rate? Paul Graham says 5%-7% w/w and David Sacks says 15%-20% per month (which is slightly slower). You can easily find 100 other benchmarks for the numbers above on Twitter and VC blogs/podcasts -— but unless you’re going into investment, there’s no use spending so much time on that, just use these numbers as a guide and then do your best.

Taken together, all these numbers mean this is how your seed growth plan should look like: You raised enough capital for X months, say 18. Just before that money runs out you better start raising your Series A with traction at around $1M ARR. Maybe you’d like a 3-month buffer to raise and in case you miss your growth goals. With a growth rate of 5% w/w, how long does it take to make $1M ARR? Should you start at month 12 after your Seed? Or month 3? How long does that leave you to reach PMF? What if you missed the start of growth by a few months, how fast do you need to grow now to catch up? How many users does that mean you need to bring every week?

Build an excel file tracking these exponents. Fill in your target end date (3 months before you run out of cash, so you need to raise your next round). Put in a starting amount of users you will get from your first blast/launch (perhaps users in your waiting list or a major first push — like 100 or so). Then, set your goal number of users, and what your predicted weekly churn rate is. Figure out when will growth start (i.e when do you launch). What happens if you give yourself 4 months to grow? Is that a realistic growth rate or will you need to hit rarely seen >10% w/w growth? How about 10 months? Do you have 10+3 months left your runway or should you start growth against weekly goals today?

You can create a table that gives you the exact week-by-week goals for growth that you can just print and share with your team. You can put in how much did you actually realize every week and are you ahead or behind goal. Focusing just on this, as Paul Graham says, will guide you to success or to a better idea for your startup.

Focusing on hitting a growth rate reduces the otherwise bewilderingly multifarious problem of starting a startup to a single problem.

— P. Graham

This model is the basic one, and you can go fancy and add more options — splitting out by organic and paid growth, by channel, or adding in varying revenue; You can easily model some low and capped virality (e.g, every person might lead to up to 3 more people with 15% probability).